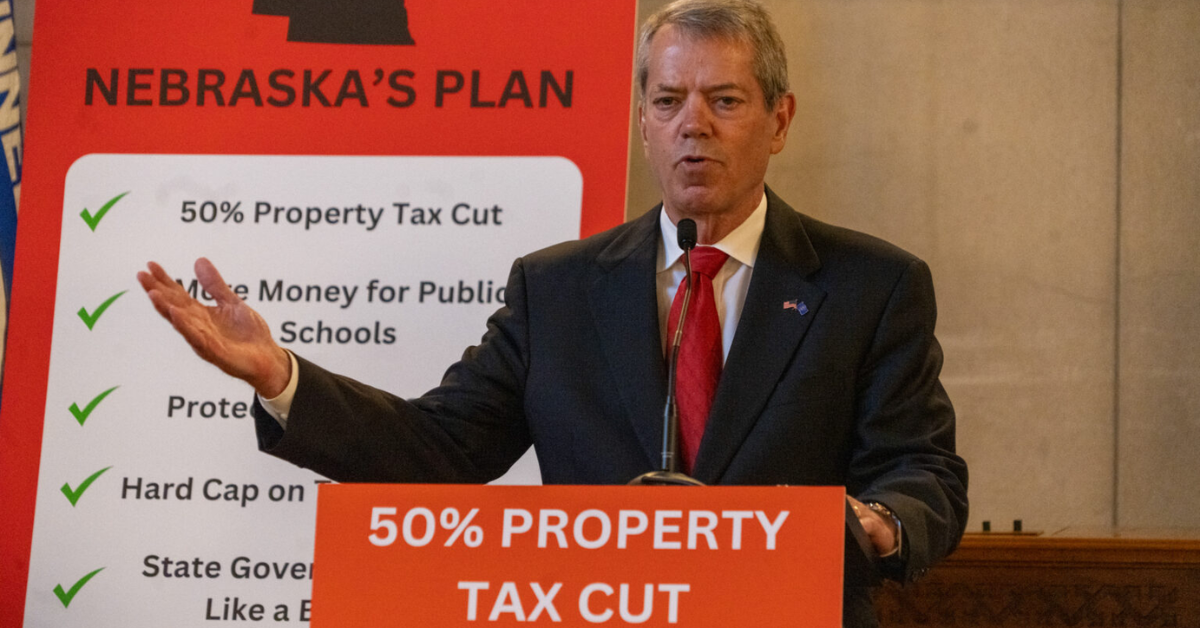

Nebraska Governor Jim Pillen has introduced a new property tax plan, setting the stage for a statewide debate on taxes. The plan aims to reduce property tax burdens, an issue that has been a focal point of his administration.

Tax reform is expected to take center stage in the 2025 legislative session as lawmakers explore solutions to create a more equitable tax system. The governor, along with many Republicans, has called for “realistic tax reform,” but the question remains: what does that mean for Nebraska residents?

Compared to other states, Nebraska’s tax structure is not overly excessive. Taxes here aren’t the biggest issue, but there’s room for improvement. Any serious attempt at tax reform must be guided by sound principles. These include ensuring the broadest tax base possible, fairness based on an individual’s ability to pay, progressive tax rates, and a system resilient to economic changes. A tax system built on these principles can support Nebraska’s economy, its democracy, and its society as a whole.

Tax fairness is critical for a thriving state. However, some proposed reforms risk increasing burdens on those who are least able to afford it. Often, these proposals benefit the wealthiest individuals, large corporations, and major landowners, leaving working families, retirees, and small businesses to shoulder more of the load. For tax reform to truly benefit Nebraska, it must reduce burdens on those with limited resources while ensuring that the wealthiest contribute their fair share.

Governor Pillen’s focus on reducing property tax burdens is a step in the right direction. This issue resonates with many Nebraskans, especially those struggling to keep up with rising costs. One of his proposals involves reducing the number of services that are exempt from sales tax.

This idea has merit. By expanding the sales tax base to include more services, the state can generate additional revenue, which could then be used to lower overall tax rates. However, it’s crucial to ensure this approach doesn’t shift the burden onto working families. Tax systems work best when they balance fairness and efficiency.

Taxes, while often unpopular, are essential for funding government services. Despite some rhetoric suggesting that “government is the problem,” the truth is that government plays a vital role in the United States and Nebraska.

It supports infrastructure, education, public safety, and countless other services that benefit all residents. While it’s fair to debate the appropriate size and scope of government, we must also recognize the need for a sustainable system to fund its operations. A fair tax system ensures that everyone—households, small businesses, nonprofits, and corporations—contributes their share.

Nebraska’s tax system could benefit from several key reforms. One idea is to reduce or eliminate sales tax exemptions. This would broaden the tax base and allow the state to lower sales tax rates for all goods and services.

Another option is to exempt a base level of spending, income, and property value for families and small businesses, easing the burden on those who are struggling the most. At the same time, corporate economic development incentives could be phased out, redirecting resources toward investments in workforce development, innovation, infrastructure, and entrepreneurship.

Another innovative idea involves creating a sovereign wealth fund similar to the one in Norway. Such a fund could draw revenue from expanded severance taxes or value-related sales taxes on industries like agriculture and energy production. The revenue generated could be invested in areas like education, health care, affordable housing, and research. Over time, this fund could provide a stable source of funding for essential state functions, reducing reliance on general tax revenue.

Nebraska has already taken small steps toward this model with initiatives like the Environmental Trust and arts and humanities endowments. Expanding these programs could further relieve the tax burden on residents. For example, public services like arts and tourism promotion, environmental projects, and library support could be funded through state-chartered corporations. These corporations would operate independently but be accountable to the state, ensuring that public funds are used efficiently.

Encouraging local investment is another strategy that could benefit Nebraska communities. By growing community foundations, the state could empower local leaders to address specific needs in their areas. This approach would foster greater self-reliance and reduce the need for state-level intervention in every local issue.

Governor Pillen’s tax plan has sparked an important conversation about Nebraska’s future. The goal should be to create a system that is fair, efficient, and sustainable. While reducing property taxes is a popular idea, it must be done in a way that doesn’t increase burdens on working families or undermine essential services. Expanding the sales tax base, eliminating unnecessary exemptions, and exploring new revenue streams are all promising strategies that could make Nebraska’s tax system more equitable.

As the debate unfolds, it’s essential for Nebraskans to stay engaged. Tax reform will shape the state’s economy and society for years to come. By focusing on fairness and long-term stability, lawmakers can create a system that benefits all residents, not just a select few. The decisions made in the coming months will have far-reaching implications, making it more important than ever for Nebraskans to make their voices heard.

The road ahead is challenging, but it also presents an opportunity. Nebraska has the chance to lead by example, showing other states how to balance fiscal conservatism with fairness and equity. By building a tax system that works for everyone, Nebraska can lay the foundation for a stronger, more prosperous future.

Disclaimer: This article has been meticulously fact-checked by our team to ensure accuracy and uphold transparency. We strive to deliver trustworthy and dependable content to our readers.